As businesses worldwide recover and adapt to the pandemic, a significant shift is occurring in how companies approach employee ownership, engagement, and alignment. Economic turbulence and changing work culture have prompted leaders to rethink organizational structures and workforce incentives. Companies are increasingly exploring models—from traditional corporate structures to innovative ownership-based systems like ESOPs (Employee Stock Ownership Plans) and profit-sharing plans.

This evolution compels businesses to not only offer financial rewards but also foster deeper emotional commitment from employees. Understanding this shift is crucial for both employers aiming to drive growth and employees seeking personal alignment and fulfillment.

The Push for Shared Ownership

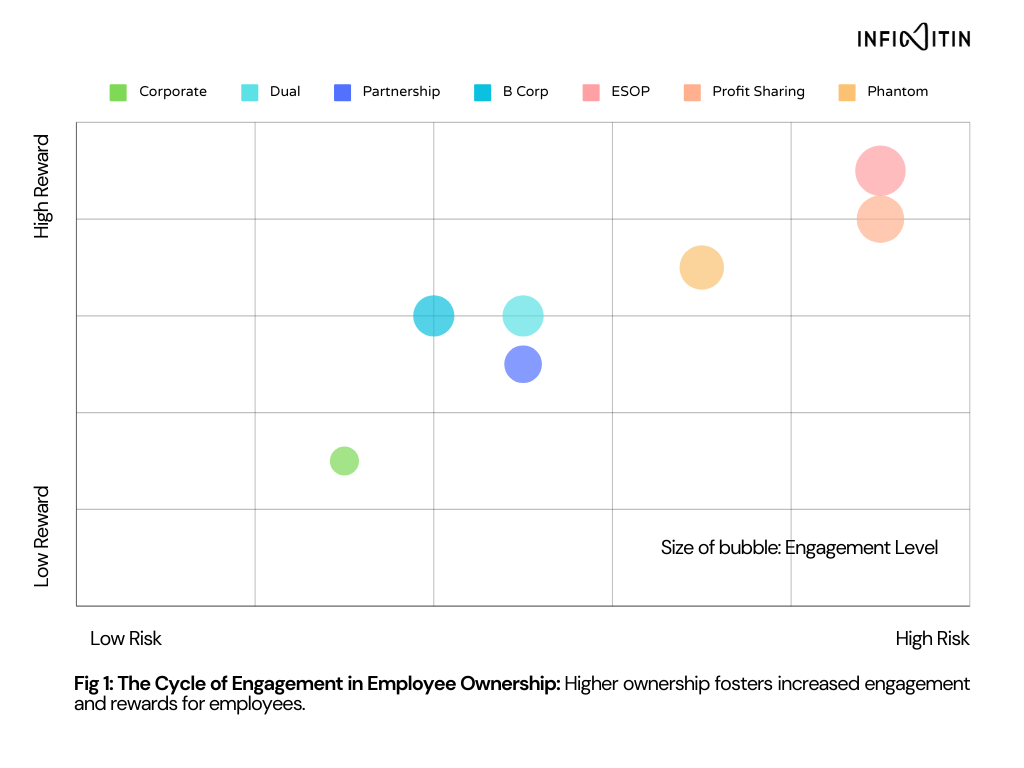

The traditional corporate model, where ownership is concentrated at the top and employees receive fixed salaries, is being challenged. The rise of ESOPs, dual-class structures, profit-sharing, B Corps, and phantom stock options is reshaping the employer-employee dynamic. These models provide more than profit-sharing; they create a sense of belonging and personal investment in the company’s success.

However, opportunity brings risk, leading to discussions on balancing reward and risk with employee buy-in. Employers should consider how to align these models with growth strategies while ensuring operational stability. They should weigh potential rewards against the risks and personal investments involved.

This article examines how employers and employees can strategically balance reward and risk, aligning engagement with long-term business success.

Exploring Ownership Models: From Ownership to Engagement

1. Traditional Corporate Structures: The Baseline Approach

At one end, the traditional corporate model centralizes ownership and control among external shareholders and executives. Employees are typically incentivized through salary, benefits, and performance bonuses but often have little say in business operations, leading to detachment. The risks and rewards remain with owners, resulting in emotional disengagement from employees, who may feel like cogs in the machine. While this model offers stability, it lacks the emotional buy-in essential for innovation and retention, especially as the pandemic has heightened demands for purpose and autonomy.

What Works: Simple hierarchy, strong capital access, reliable short-term profits.

What Needs Improvement: Boost engagement, increase decision involvement, balance short- and long-term goals.

Walmart and Tata Consultancy Services illustrate this model, where employees have a fixed salary with some minor bonuses but little direct ownership.

Despite its drawbacks, many companies, particularly in capital-intensive industries, continue to rely on this model. However, many are now seeking more modern solutions that promote employee engagement and retention.

2. Hybrid Models: Balancing Control and Participation

Dual-class, partnerships and B Corp introduce a hybrid approach where employees have a stake in the company’s success without full ownership. While these models offer moderate risk and reward, they encourage engagement by connecting employees to the company’s fortunes. However, the lack of a clear path to full ownership may leave some employees feeling under-incentivized over time.

While these (Hybrid) models offer moderate risk and reward, they encourage engagement by connecting employees to the company’s fortunes. However, the lack of a clear path to full ownership may leave some employees feeling under-incentivized over time.

- Dual-Class Share Structures: Companies can issue multiple classes of stock, allowing founders and executives to retain voting power while employees benefit financially from stock ownership. This preserves decision-making authority at the top while rewarding employees. Alphabet exemplifies this model, where founders maintain control, but employees can own non-voting shares.

- Partnership Models: Common in law, consulting, and accounting, this model offers senior employees (partners) ownership while junior employees work under a traditional structure, creating clear advancement incentives but potential divides. Goldman Sachs operates as a partnership system, with senior employees sharing in profits and decisions.

- B Corporations: Benefit Corporations balance profit with social responsibility. Employees may not always be owners, but they engage in mission-driven work, aligning their values with the company’s goals. Patagonia and Ben & Jerry’s embody B Corps by aligning profits with social and environmental responsibilities.

What Works: Flexible management, balanced short- and long-term focus, employee incentives boost motivation.

What Needs Improvement: Simplify governance, align employee and management goals, improve financial predictability.

Why Hybrid Models Matter Post-COVID

Hybrid structures appeal to companies navigating uncertain times, offering flexibility. With the global workforce demanding more purpose and impact in their jobs, hybrid models like B Corps or partnerships are increasingly explored, allowing businesses to meet the desire for a say in company direction while maintaining control.

3. Employee Ownership Models: Driving Engagement and Retention

ESOPs (Employee Stock Ownership Plan), profit-sharing, and phantom stocks represent the highest levels of ownership and engagement. These models operate on the belief that giving employees a stake in the business enhances engagement, retention, and long-term performance. Employees not only share in profits but also have a significant say in decision-making. While fostering deep emotional commitment, these models come with higher financial risks for employees tied to the company’s performance. The potential rewards are substantial, but clear communication regarding risks, especially liquidity concerns, is essential.

- ESOPs: Structured programs where employees earn shares over time. The cultural shift that accompanies ESOPs can be profound, requiring a commitment to communication and alignment. Penmac Staffing and WinCo Foods exemplify 100% employee-owned companies with high engagement.

- Profit-Sharing: Rewards employees based on company profits rather than shares, making it easier to implement short-term but may lack the ownership mentality of an ESOP. Ford uses profit-sharing based on company performance, but without direct stock ownership.

- Phantom Stock Options: Employees are promised future stock or equivalents based on performance, driving long-term engagement despite lacking immediate ownership. Hilton Hotels and Adobe incentivize employees with phantom stock options without diluting equity.

- Co-operative: In an employee-owned company, members have equal decision-making power, fostering a democratic, yet more bureaucratic environment. While an ESOP with 100% employee ownership grants financial stakes, it doesn’t ensure cooperative status unless it also allows for direct governance control. REI operates as a consumer cooperative where customers and employees are engaged and have stakes in the business’s success.

What Works: High engagement aligned interests drive long-term success, strong culture fosters loyalty.

What Needs Improvement: Simplify setup, educate employees, maintain stability during transitions.

These (Employee ownership) models operate on the belief that giving employees a stake in the business enhances engagement, retention, and long-term performance. Employees not only share in profits but also have a significant say in decision-making.

The Post-COVID Imperative for Employee Ownership

The pandemic has accelerated the demand for employee ownership models. With companies struggling to attract and retain talent in a remote, disrupted world, models like ESOPs are gaining traction to connect employee engagement directly to performance. Employee ownership fosters loyalty, reduces turnover, and cultivates a culture of mutual success.

The Emotional Buy-In: What Matters for Employees

Ownership models now encompass financial incentives and purpose-driven alignment. Employees increasingly seek companies that align with their values and provide ownership over their work. This emotional buy-in is critical; employers who fail to recognize this may struggle with disengaged teams, while those who do can unlock higher levels of commitment, creativity, and productivity.

The success of employee ownership models hinges on the emotional connection employees feel to their roles. Leaders must prioritize communication, fostering a culture where employees understand and value their ownership role. Managing the cultural shift that accompanies employee ownership is vital to avoiding conflicts and ensuring long-term success.

Ultimately, there is no one-size-fits-all model; the choice among traditional, hybrid, and employee ownership models depends on a company’s goals, industry, and vision. However, the trend across industries favors shared ownership and increased engagement.

By adopting ownership structures that balance financial incentives with emotional engagement, private equity firms and business owners can create more sustainable and profitable businesses. Recognizing employees as potential owners and partners in success is key.

Balancing Risk, Reward, and Engagement

The future of work involves employees being emotionally committed to their company’s success, not just financially invested. Employers must find the right balance—offering sufficient rewards to motivate employees, managing risk, and creating an environment where employees feel they have a stake in the company’s future.

As we navigate this shift, the question isn’t merely “Which model is best?” but rather “How can we build a structure that encourages employees to be as emotionally invested as they are financially?” This is the challenge—and opportunity—facing businesses today.